Monday, September 29, 2008

Money fears

Doesn't this new version of the dollar bill do a perfect job capturing the essence of the Treasury Department's current state of mind?

Thursday, September 18, 2008

Oh my Goldman

I got a first-hand sense of how badly Goldman Sachs felt the pressure of the crumbling financial markets this morning.

At the start of a private company's board meeting I was attending, a director received a call on his cell phone. One member of the board had not yet arrived, so the director answered the call in case it was the missing attendee. He dispatched with the caller after about a minute.

The caller turned out to be his broker from Goldman Sachs who was calling to relay a simple message: If Goldman goes under, don't worry, your assets will still be safe.

I almost fell out of my chair. The senior executives at Goldman decided the perceived threat to the investment bank was so great that they instructed brokers to call clients proactively to address concerns about the company's failure. Wow.

Monday, October 22, 2007

He has no credibility, but I think he's 100% correct

For several months now, I have been privately telling anyone willing to listen that search advertising, though incredibly effective, is over rated. At first glance, it would appear that advertising to someone in context of his search activity is an utter utopia for marketers. What better time to advertise a DVD player, for example, than when a consumer types "DVD player" into Google's search box. I agree that in context advertising is as close to utopia as marketers will ever get, but they cannot ignore their other marketing efforts.

What many search advertisers are failing to consider is the impact all their other marketing spend has on their search spend. Back to my example: when you search for "DVD player" on Google, there's a reason why you're 100 times more likely to click on a link to Samsung rather than a link to Apex. For starters, you have heard of Samsung but you've probably never heard of Apex. Second, when you researched various DVD players over the prior few days, you read a lot of positive reviews about the Samsung product but saw next to nothing on the Apex product. Finally, Samsung has a high-tech, high-quality brand. Apex has a cheap, made in a low quality way kind of brand.

Today Bloomberg news reported that Brian McAndrews, an executive at Microsoft, predicts ad buyers will switch away from search advertising and towards display advertising. At face value, it looks like a desperate attempt from Microsoft, which is badly trailing Google in search, to pooh-pooh the segment where it is weak and try to persuade advertisers that banner ads are more important. It's definitely a convenient argument given Microsoft's massive quantity of unsold banner ad inventory and weak search market share.

However, there is an element of truth in the statement. Advertisers are failing to examine the impact their non-search advertising is having on search. They are attributing all of their advertising success to search simply because it is usually the last ad seen by a user before the purchase. Just because it's the last ad doesn't mean it's the only (or even most) important one.

What advertisers need -- and what I would like to invest in -- is a company offering a web-based analytic product that helps bring banner ads, email marketing and search marketing all into a single dashboard/framework. It would allow an advertiser to measure the impact of increased banner advertising on the efficacy of its search marketing. In other words, the tool would allow advertisers to properly measure and allocate performance across ad media.

I have yet to come across such a product. Have you?

What many search advertisers are failing to consider is the impact all their other marketing spend has on their search spend. Back to my example: when you search for "DVD player" on Google, there's a reason why you're 100 times more likely to click on a link to Samsung rather than a link to Apex. For starters, you have heard of Samsung but you've probably never heard of Apex. Second, when you researched various DVD players over the prior few days, you read a lot of positive reviews about the Samsung product but saw next to nothing on the Apex product. Finally, Samsung has a high-tech, high-quality brand. Apex has a cheap, made in a low quality way kind of brand.

Today Bloomberg news reported that Brian McAndrews, an executive at Microsoft, predicts ad buyers will switch away from search advertising and towards display advertising. At face value, it looks like a desperate attempt from Microsoft, which is badly trailing Google in search, to pooh-pooh the segment where it is weak and try to persuade advertisers that banner ads are more important. It's definitely a convenient argument given Microsoft's massive quantity of unsold banner ad inventory and weak search market share.

However, there is an element of truth in the statement. Advertisers are failing to examine the impact their non-search advertising is having on search. They are attributing all of their advertising success to search simply because it is usually the last ad seen by a user before the purchase. Just because it's the last ad doesn't mean it's the only (or even most) important one.

What advertisers need -- and what I would like to invest in -- is a company offering a web-based analytic product that helps bring banner ads, email marketing and search marketing all into a single dashboard/framework. It would allow an advertiser to measure the impact of increased banner advertising on the efficacy of its search marketing. In other words, the tool would allow advertisers to properly measure and allocate performance across ad media.

I have yet to come across such a product. Have you?

Thursday, May 10, 2007

What are you reading?

I always like to know what smart, tech types include in their daily reading. Yesterday, I learned that a very successful entrepreneur (and good friend of mine) named Chris Dixon put up a web site with links to a few dozen of his favorite blogs and websites, and this afternoon I finally got around to studying the list. I have been particularly curious to know what Chris reads because he always seems to know about the latest new idea at least a few weeks before I find out about it, and when I do finally learn about the new, new thing, it's often Chris that tells me about it.

I already knew about many of the links on Chris' new web page, but as expected there were a few gems that I hadn't yet discovered. I hope he keeps this up-to-date. Maybe it's time for someone launch a meta RSS feeder so I can get a feed of changes to other people's RSS readers.

I already knew about many of the links on Chris' new web page, but as expected there were a few gems that I hadn't yet discovered. I hope he keeps this up-to-date. Maybe it's time for someone launch a meta RSS feeder so I can get a feed of changes to other people's RSS readers.

Thursday, March 29, 2007

My Click Fraud Theory

With the astounding growth of auction-based pay-per-click (PPC) advertising led by Google and Yahoo over the past several years, there is a great deal of discussion about click fraud. I think most people are completely missing the point. Those who are complaining about the issue really have nothing to complain about. Bizarrely, those who are getting screwed haven’t even uttered a peep.

Click fraud takes place when someone clicks on a PPC ad with no real intent of actually following the link. The result, of course, is that an advertiser has to pay for a bogus click. Many advertisers are complaining about being charged for bogus clicks and are even demanding refunds. Somehow they managed to force Yahoo to settle a lawsuit for about $5 million and Google actually coughed up $90 million in a similar instance.

This baffles me because any reasonably sophisticated advertiser shouldn’t really care about click fraud. Why? Because if they’re using any of the dozens of off-the-shelf tools to measure their PPC ad conversion rates, they would be automatically lowering their PPC bids to maintain an acceptable ROI. An advertiser simply shouldn’t care if he pays $1 per click for 10 clicks that yield 10% conversion and a single customer or if he pays $0.50 per click for 20 clicks that yield 5% conversion and a single customer. In either case, the advertiser has paid $10 to land a new customer.

Given the real-time tracking capabilities inherent in auction-based PPC, click fraud gets priced into the equation automatically. In my example above, the bogus clicks drove conversion down by 50% (from 10% to 5%), and advertisers adjusted their bids from $1 to $0.50 per click. Yes, in theory the advertiser may suffer temporarily from fraudulent clicks before he has a chance to adjust his bid downward to compensate for the lower conversion rate, but today’s automated systems figure this out pretty quickly. Any real damage to the advertiser is inconsequential.

So why are advertisers complaining? I don’t get it. Perhaps they haven’t all figured out how easy it is to use tools from search engine marketing (SEM) experts such as Efficient Frontier, SearchRev, iCrossing, iProspect (or many, many others). These SEM experts offer reasonably cheap software to solve the problem through automated bidding.

Perhaps some advertisers believe only their ads are being clicked fraudulently. Click fraud targeting a specific advertiser, does, in fact, hurt that advertiser. He can reduce his bid to maintain his conversion rate and ROI, but now he will get a much lower number of clicks because his competitors can afford to bid higher if they aren't suffering from the same click fraud. Though I acknowledge that advertiser-targeted click fraud is possible, I believe most click fraudsters are just trying to make money for a certain publisher rather than trying to deplete the ad budget of a certain competitor. So, I'm at a loss to explain why advertisers seem to care so much about click fraud.

Even more confounding, however, is that the companies who are really getting screwed haven't started screaming about it. In fact, we haven't heard anything from them. The companies on the losing end of click fraud are high quality web site publishers. When an unscrupulous publisher engages in click fraud to increase revenues, the result is reduced conversion rates for advertisers, who, naturally, lower their bids. Because of the way most advertisers participate in Google and Yahoo PPC auctions, when they reduce their bids, the reduction applies to every publisher in the Google and Yahoo networks.

If publisher A is engaging in click fraud, which causes lower PPC bids from advertisers, publisher B gets screwed. Publisher B doesn't generate any additional clicks, but now he's getting less revenue for each click. In a sense, publisher A just stole money from publisher B. My theory is that the publisher getting screwed the most is probably AOL.

I suppose it's not too surprising that high quality publishers aren't complaining because it's virtually impossible to detect this phenomenon. This is especially true because Google provides publishers with such a minimal amount of information about their advertising performance. Perhaps one reason Google is holding on so tightly to the lack of transparency in its system relates to keeping click fraud off the agenda of high quality publishers.

Click fraud takes place when someone clicks on a PPC ad with no real intent of actually following the link. The result, of course, is that an advertiser has to pay for a bogus click. Many advertisers are complaining about being charged for bogus clicks and are even demanding refunds. Somehow they managed to force Yahoo to settle a lawsuit for about $5 million and Google actually coughed up $90 million in a similar instance.

This baffles me because any reasonably sophisticated advertiser shouldn’t really care about click fraud. Why? Because if they’re using any of the dozens of off-the-shelf tools to measure their PPC ad conversion rates, they would be automatically lowering their PPC bids to maintain an acceptable ROI. An advertiser simply shouldn’t care if he pays $1 per click for 10 clicks that yield 10% conversion and a single customer or if he pays $0.50 per click for 20 clicks that yield 5% conversion and a single customer. In either case, the advertiser has paid $10 to land a new customer.

Given the real-time tracking capabilities inherent in auction-based PPC, click fraud gets priced into the equation automatically. In my example above, the bogus clicks drove conversion down by 50% (from 10% to 5%), and advertisers adjusted their bids from $1 to $0.50 per click. Yes, in theory the advertiser may suffer temporarily from fraudulent clicks before he has a chance to adjust his bid downward to compensate for the lower conversion rate, but today’s automated systems figure this out pretty quickly. Any real damage to the advertiser is inconsequential.

So why are advertisers complaining? I don’t get it. Perhaps they haven’t all figured out how easy it is to use tools from search engine marketing (SEM) experts such as Efficient Frontier, SearchRev, iCrossing, iProspect (or many, many others). These SEM experts offer reasonably cheap software to solve the problem through automated bidding.

Perhaps some advertisers believe only their ads are being clicked fraudulently. Click fraud targeting a specific advertiser, does, in fact, hurt that advertiser. He can reduce his bid to maintain his conversion rate and ROI, but now he will get a much lower number of clicks because his competitors can afford to bid higher if they aren't suffering from the same click fraud. Though I acknowledge that advertiser-targeted click fraud is possible, I believe most click fraudsters are just trying to make money for a certain publisher rather than trying to deplete the ad budget of a certain competitor. So, I'm at a loss to explain why advertisers seem to care so much about click fraud.

Even more confounding, however, is that the companies who are really getting screwed haven't started screaming about it. In fact, we haven't heard anything from them. The companies on the losing end of click fraud are high quality web site publishers. When an unscrupulous publisher engages in click fraud to increase revenues, the result is reduced conversion rates for advertisers, who, naturally, lower their bids. Because of the way most advertisers participate in Google and Yahoo PPC auctions, when they reduce their bids, the reduction applies to every publisher in the Google and Yahoo networks.

If publisher A is engaging in click fraud, which causes lower PPC bids from advertisers, publisher B gets screwed. Publisher B doesn't generate any additional clicks, but now he's getting less revenue for each click. In a sense, publisher A just stole money from publisher B. My theory is that the publisher getting screwed the most is probably AOL.

I suppose it's not too surprising that high quality publishers aren't complaining because it's virtually impossible to detect this phenomenon. This is especially true because Google provides publishers with such a minimal amount of information about their advertising performance. Perhaps one reason Google is holding on so tightly to the lack of transparency in its system relates to keeping click fraud off the agenda of high quality publishers.

Sunday, March 25, 2007

My Simple Multiple Choice Test For Consumer Internet Startups

Anyone thinking about starting or joining a consumer Internet startup should be able to answer the following question, and if the answer is "d) none of the above," then I'd suggest looking for a new job.

So, here's the question: does your company attract users with any of these things?

There's also a group of startups who think they have passed the multiple choice test, but that's because they have misunderstood the answers. This blog post is my attempt to clarify them.

1. An inherently viral idea

Very, very few sites can correctly offer this answer because very few concepts are inherently viral. You may have a great site and may rightfully think users will tell their friends about it, but you probably don't have a viral site. You're not benefiting from a viral idea, you're benefiting from word of mouth. Word of mouth is nice, but it's not nice enough to form the foundation of a business. To be viral, the utility of your site/service needs to grow substantially as your friends use the service. Great examples of inherently viral services include Skype (with no friends to call, it's useless), Facebook (you can't trade messages with your friends if they're not on the site) and LinkedIn (you can't access your business network if you haven't established it on the site). Bessemer had one fantastic investment success with Skype and is hoping for a second with LinkedIn. Too bad we missed out on Facebook.

Viral ideas are the most powerful of all because they grow exponentially. Skype had 500,000 users less than a month after beta launch in the summer of 2003 and has reached more than 100,000,000 people since.

2. Search engine optimized content that grows naturally with usage

Almost everything starts with Google and its search engine brethren these days. If you can build a service with lots of web pages that get indexed by Google and show up naturally as top results for a large number of searches, you will get a lot of free traffic. It sounds simple. But it's not.

There are dozens of techniques and tricks to building search engine optimized (SEO) web sites, and there are countless firms who will sell you advice on how to do it correctly. Most importantly, though, the idea underlying your site must lend itself naturally to SEO. First, consumers have to be doing a lot of searches for content on your site. Second, your content has to grow -- ideally through contributions from users. Bessemer had a very successful investment in Site Advisor (acquired by McAfee) that leveraged SEO distribution. Several of our current investments -- OLX, Wikia and Yelp are SEO-driven.

3. The ability to spend money to acquire users with a very fast payback

If you can spend money to make money, you can control your own destiny. Generally, you have to be in the business of selling something to consumers. Online retailers are great examples of companies in this category. If 2% of visitors complete a purchase and if the average purchase is a $50 with a 30% gross margin, then you can afford to spend $0.30 for a visitor. Assuming a small fraction of the eventual purchasers will become repeat buyers, you will have a profitable business. Retailers and subscription sites like Improvement Direct and Match are great examples. In fact, most of the IAC properties fit in this category. Online media properties that monetize through advertising can rarely spend money to make money. It just costs too much to acquire a customer.

There are a few companies like LinkedIn and Yelp that benefit from more than one of the user acquisition techniques mentioned above. LinkedIn is primarily viral but leverages SEO through its personal profile pages. Yelp is primarily SEO driven but has a viral element among its core contributors who invite friends to the service to share and compare reviews.

There may be one other compelling customer acquisition strategy for consumer Internet companies, but in my mind, the jury is still out. This fourth technique leverages the open APIs for widgets offered by MySpace and many of the leading social networks. Although it's clear you can drive tremendous usage through widget-based distribution, I'm not yet convinced that these widget companies will develop viable business models.

So, here's the question: does your company attract users with any of these things?

- an inherently viral idea

- search engine optimized content that grows naturally with usage

- the ability to spend money to acquire users with a very fast payback

- none of the above

There's also a group of startups who think they have passed the multiple choice test, but that's because they have misunderstood the answers. This blog post is my attempt to clarify them.

1. An inherently viral idea

Very, very few sites can correctly offer this answer because very few concepts are inherently viral. You may have a great site and may rightfully think users will tell their friends about it, but you probably don't have a viral site. You're not benefiting from a viral idea, you're benefiting from word of mouth. Word of mouth is nice, but it's not nice enough to form the foundation of a business. To be viral, the utility of your site/service needs to grow substantially as your friends use the service. Great examples of inherently viral services include Skype (with no friends to call, it's useless), Facebook (you can't trade messages with your friends if they're not on the site) and LinkedIn (you can't access your business network if you haven't established it on the site). Bessemer had one fantastic investment success with Skype and is hoping for a second with LinkedIn. Too bad we missed out on Facebook.

Viral ideas are the most powerful of all because they grow exponentially. Skype had 500,000 users less than a month after beta launch in the summer of 2003 and has reached more than 100,000,000 people since.

2. Search engine optimized content that grows naturally with usage

Almost everything starts with Google and its search engine brethren these days. If you can build a service with lots of web pages that get indexed by Google and show up naturally as top results for a large number of searches, you will get a lot of free traffic. It sounds simple. But it's not.

There are dozens of techniques and tricks to building search engine optimized (SEO) web sites, and there are countless firms who will sell you advice on how to do it correctly. Most importantly, though, the idea underlying your site must lend itself naturally to SEO. First, consumers have to be doing a lot of searches for content on your site. Second, your content has to grow -- ideally through contributions from users. Bessemer had a very successful investment in Site Advisor (acquired by McAfee) that leveraged SEO distribution. Several of our current investments -- OLX, Wikia and Yelp are SEO-driven.

3. The ability to spend money to acquire users with a very fast payback

If you can spend money to make money, you can control your own destiny. Generally, you have to be in the business of selling something to consumers. Online retailers are great examples of companies in this category. If 2% of visitors complete a purchase and if the average purchase is a $50 with a 30% gross margin, then you can afford to spend $0.30 for a visitor. Assuming a small fraction of the eventual purchasers will become repeat buyers, you will have a profitable business. Retailers and subscription sites like Improvement Direct and Match are great examples. In fact, most of the IAC properties fit in this category. Online media properties that monetize through advertising can rarely spend money to make money. It just costs too much to acquire a customer.

There are a few companies like LinkedIn and Yelp that benefit from more than one of the user acquisition techniques mentioned above. LinkedIn is primarily viral but leverages SEO through its personal profile pages. Yelp is primarily SEO driven but has a viral element among its core contributors who invite friends to the service to share and compare reviews.

There may be one other compelling customer acquisition strategy for consumer Internet companies, but in my mind, the jury is still out. This fourth technique leverages the open APIs for widgets offered by MySpace and many of the leading social networks. Although it's clear you can drive tremendous usage through widget-based distribution, I'm not yet convinced that these widget companies will develop viable business models.

Tuesday, February 27, 2007

Small Businesses are Starting to 'Get' Local 2.0

As an investor in Yelp, I was delighted to discover this blog post by Peggy Wynne Borgman, the owner of Saratoga Spa. In it, she admits to ranting about the dark side of user generated content for months before recently changing her tune and "falling in love" with Yelp.

Initially, I wondered: why the sudden change of heart? Had a savvy business person at Yelp managed to bribe Peggy into becoming a fan? Nope. This love affair is genuine.

Peggy figured out that the "web 2.0" experience for local search is about two-way communication. She discovered that Yelp provided her with a way to monitor her spa's reputation very efficiently. Now, she checks Yelp daily. Any time she notices an "issue" with her spa's reputation, she can address it by starting a dialog with the unhappy customer.

In many cases, she manages to get a second chance with these disgruntled customers and win them back.

Before Yelp's existence, these unhappy customers would simply stew on their bad experiences and trash the local vendor among their friends. The poorly performing local merchants never even knew they were doing such a bad job. Thanks to Yelp, business owners get access to timely feedback and, more importantly, they can address issues that emerge in the feedback. Isn't it every business owner's dream to know what customers think and get a chance to fix the problems?

Initially, I wondered: why the sudden change of heart? Had a savvy business person at Yelp managed to bribe Peggy into becoming a fan? Nope. This love affair is genuine.

Peggy figured out that the "web 2.0" experience for local search is about two-way communication. She discovered that Yelp provided her with a way to monitor her spa's reputation very efficiently. Now, she checks Yelp daily. Any time she notices an "issue" with her spa's reputation, she can address it by starting a dialog with the unhappy customer.

In many cases, she manages to get a second chance with these disgruntled customers and win them back.

Before Yelp's existence, these unhappy customers would simply stew on their bad experiences and trash the local vendor among their friends. The poorly performing local merchants never even knew they were doing such a bad job. Thanks to Yelp, business owners get access to timely feedback and, more importantly, they can address issues that emerge in the feedback. Isn't it every business owner's dream to know what customers think and get a chance to fix the problems?

Wednesday, December 13, 2006

Sleeping at Night for $5 a month

Several months ago, I confessed to being a Scan Artist. I bought a fantastic, speedy desktop scanner from Fujitsu and converted almost every paper record in my home office into a PDF file. I don't keep hard copies of anything anymore.

There are many virtues to a paper-free life. For those of us living in small Manhattan apartments, the space saved by eliminating paper files was enough, by itself, to motivate my transition to committed scanner.

Remote access is a second virtue that I really enjoy. I have configured my home network to make it easy for me to log on to any of my home PCs from virtually any internet-connected computer. (Eventually, I intend to post more on this to solicit comments on the 'hackability' of my home network. For now, I'll continue to pretend that security through obscurity actually works.)

There is a third benefit of paper-free living that I have been hoping to realize for months, but only last week did it finally become a reality. With all my important home/personal records on paper, a house fire or flood would have been disastrous. With everything stored digitally, I thought it would be trivial to keep an off-site copy of everything. After investigating a number of alternatives, I couldn't find a cheap and reliable way to maintain a backup.

I thought about copying my files onto DVDs, but the manual process is much too laborious. I thought about copying them to my laptop, but I have more than 50 gigabytes of data to backup, and my laptop hard disk doesn't have sufficient capacity. There are dozens of online backup services but none offers what I want:

The only gotcha was the time it took to complete the first backup. My roughly 50GB of data required 22,000 minutes (that's almost 16 days!) for the initial synchronization. Of course from now on, it's just the incremental changes that get copied, so it will be a lot faster. It was a very painful reminder that cable broadband isn't really broadband in the upload direction.

Now if one of my neighbors drops a lit cigarette into the trash and sets my building on fire, I can focus on getting my family to safety without having to grab a hard drive while rushing to the fire escape.

There are many virtues to a paper-free life. For those of us living in small Manhattan apartments, the space saved by eliminating paper files was enough, by itself, to motivate my transition to committed scanner.

Remote access is a second virtue that I really enjoy. I have configured my home network to make it easy for me to log on to any of my home PCs from virtually any internet-connected computer. (Eventually, I intend to post more on this to solicit comments on the 'hackability' of my home network. For now, I'll continue to pretend that security through obscurity actually works.)

There is a third benefit of paper-free living that I have been hoping to realize for months, but only last week did it finally become a reality. With all my important home/personal records on paper, a house fire or flood would have been disastrous. With everything stored digitally, I thought it would be trivial to keep an off-site copy of everything. After investigating a number of alternatives, I couldn't find a cheap and reliable way to maintain a backup.

I thought about copying my files onto DVDs, but the manual process is much too laborious. I thought about copying them to my laptop, but I have more than 50 gigabytes of data to backup, and my laptop hard disk doesn't have sufficient capacity. There are dozens of online backup services but none offers what I want:

- At least 100 gigabytes of online storage with the potential to add more as my document library grows.

- A large, profitable company standing behind the online service (or some type of distributed infrastructure that does not depend on the balance sheet of a small company)

- A way to encrypt my files, before they leave my desktop, so I can rest assured that my sensitive records will never be read by anyone else.

- For $25, buy Syncback from a small publisher called 2 Bright Sparks. The product is cheap but fabulous. It is infinitely configurable to back files up from one location to another. The destination can be another local disk or directory or it can be a remote FTP server. You can schedule and group backups with dozens of options including on-the-fly encryption of files into 256-bit AES encrypted ZIP archives.

- For $4.99 a month, get a Home Hosting package from 1and1 Internet. It comes with two free domain name registrations, 100 GB of online disk space accessible via FTP with 1 TB of monthly bandwidth. It also includes some free email accounts.

The only gotcha was the time it took to complete the first backup. My roughly 50GB of data required 22,000 minutes (that's almost 16 days!) for the initial synchronization. Of course from now on, it's just the incremental changes that get copied, so it will be a lot faster. It was a very painful reminder that cable broadband isn't really broadband in the upload direction.

Now if one of my neighbors drops a lit cigarette into the trash and sets my building on fire, I can focus on getting my family to safety without having to grab a hard drive while rushing to the fire escape.

Saturday, November 04, 2006

Changing gears

Changing gears -- smoothly and at the right time -- is something that the best venture capitalists do extremely well. By changing gears, I mean shifting from one investment theme to another.

After building expertise in big box retail investing, for example, it's no easy feat to abandon that knowledge to pursue something totally different like communications investing. Yet that is precisely what BVP partner Felda Hardymon accomplished a couple of decades ago. He led Bessemer's early stage investments in companies such as Staples and Sports Authority in the 1980s, but when he felt the trends supporting retail investments were no longer favorable, he pursued other roadmaps. He started learning about networking and communications technologies and used that newly developed expertise to invest in companies including Cascade, Sahara and Sirocco, all of which were phenomenal successes.

It's a daunting task when faced with learning about a new area, but it's a critical part of the venture capital process. Without expertise, it's impossible to make good investments (without getting very lucky), so that means you have to make bets on areas to investigate before making bets on specific teams and companies. Pick the wrong area, and you're screwed. Pen computing in the early 90s is nice example of a bad area to have selected as there isn't a single success to come from that wave of innovation despite quite a few contenders.

My own investments have spanned a number of areas, and each one has required a meaningful amount of study before I felt comfortable making a related investment. I've spent time in the world of consumer electronics (Gracenote), information services (Gerson Lehrman Group), data security (eEye and Determina) and the consumer Internet (Yelp and Wikia) to name a few. I have been working hard on a couple of new roadmaps over the past 6 months, and I hope to blog about investments in those areas later this year.

Many months ago, my colleague Justin Label began pursuit of a roadmap in clean technology. He just started to describe the transition in his new blog Venture Again. I intend to add it to my RSS reader once he gets around to setting up a feed. Justin, here's a hint!

Update: An RSS feed for Venture Again is now live here.

After building expertise in big box retail investing, for example, it's no easy feat to abandon that knowledge to pursue something totally different like communications investing. Yet that is precisely what BVP partner Felda Hardymon accomplished a couple of decades ago. He led Bessemer's early stage investments in companies such as Staples and Sports Authority in the 1980s, but when he felt the trends supporting retail investments were no longer favorable, he pursued other roadmaps. He started learning about networking and communications technologies and used that newly developed expertise to invest in companies including Cascade, Sahara and Sirocco, all of which were phenomenal successes.

It's a daunting task when faced with learning about a new area, but it's a critical part of the venture capital process. Without expertise, it's impossible to make good investments (without getting very lucky), so that means you have to make bets on areas to investigate before making bets on specific teams and companies. Pick the wrong area, and you're screwed. Pen computing in the early 90s is nice example of a bad area to have selected as there isn't a single success to come from that wave of innovation despite quite a few contenders.

My own investments have spanned a number of areas, and each one has required a meaningful amount of study before I felt comfortable making a related investment. I've spent time in the world of consumer electronics (Gracenote), information services (Gerson Lehrman Group), data security (eEye and Determina) and the consumer Internet (Yelp and Wikia) to name a few. I have been working hard on a couple of new roadmaps over the past 6 months, and I hope to blog about investments in those areas later this year.

Many months ago, my colleague Justin Label began pursuit of a roadmap in clean technology. He just started to describe the transition in his new blog Venture Again. I intend to add it to my RSS reader once he gets around to setting up a feed. Justin, here's a hint!

Update: An RSS feed for Venture Again is now live here.

Tuesday, September 26, 2006

Shorts and Longs (Cont'd)

Several months ago, I wrote my initial "shorts and longs" blog entry covering a few things I'd bet against (shorts) and a few things I like (longs). Here's a new entry in the longs column: the US economy relative to the rest of the world.

There has been a lot of talk about the US losing its leadership position to China and/or India over the next few decades. I think it's going to take a lot longer than that. Here are some interesting facts I read in a David Brooks column in the New York Times.

There has been a lot of talk about the US losing its leadership position to China and/or India over the next few decades. I think it's going to take a lot longer than that. Here are some interesting facts I read in a David Brooks column in the New York Times.

- The US economy accounted for 30.52% of the world's GDP in 1971. Today it accounts for 30.74%.

- The US accounts for 40% of the world's R&D spending.

- The US produces more engineers per capita than China or India.

- US unemployment rates for scientists and engineers are no lower than the rates for other professions, which implies the US has no real shortage of these talents despite countless press references to the contrary.

- At least 22 out of the top 30 universities in the world are American, and more foreign students come to American universities now than before 9/11/01.

Tuesday, July 18, 2006

Howard Dean Started It?

Howard Dean is often credited with being among the first to tap the power of the Internet to further the goals of a political campaign. It didn't end well for Mr. Dean, and I'm not even sure he deserves all the credit he gets for injecting the Internet into politics. I am convinced, however, that he was on to a big idea.

Since the 2004 Presidential race, there has been very little discussion in mainstream media of the Internet's role in politics. An entrepreneur named Jimmy Wales is in the process of changing that.

Jimmy is most well-known for pioneering the Wikipedia, the free online encyclopedia available in dozens of languages with millions of articles. Wikipedia is run by a staff of just two or three full-time employees because all the content is published and edited wiki-style -- i.e., by consumers. More recently, Jimmy launched Wikia, a Bessemer-backed startup. Wikia extends the Wikipedia concept to all types of content, not just the type that belongs in an encyclopedia.

Just last week, Jimmy announced his personal role in leveraging Wikia to provide the broadest, most open platform for politics on the Internet. And like everything Jimmy touches, this latest concept is flourishing quite nicely. The Campaigns Wikia is a place where people truly engage in the democratic process -- sharing ideas and debating political issues. In just a week or so, the site is already loaded with content, and almost 1,000 pundits have signed up to get involved.

It will be very interesting to witness the impact of Campaigns Wikia and other Internet platforms on future elections.

Since the 2004 Presidential race, there has been very little discussion in mainstream media of the Internet's role in politics. An entrepreneur named Jimmy Wales is in the process of changing that.

Jimmy is most well-known for pioneering the Wikipedia, the free online encyclopedia available in dozens of languages with millions of articles. Wikipedia is run by a staff of just two or three full-time employees because all the content is published and edited wiki-style -- i.e., by consumers. More recently, Jimmy launched Wikia, a Bessemer-backed startup. Wikia extends the Wikipedia concept to all types of content, not just the type that belongs in an encyclopedia.

Just last week, Jimmy announced his personal role in leveraging Wikia to provide the broadest, most open platform for politics on the Internet. And like everything Jimmy touches, this latest concept is flourishing quite nicely. The Campaigns Wikia is a place where people truly engage in the democratic process -- sharing ideas and debating political issues. In just a week or so, the site is already loaded with content, and almost 1,000 pundits have signed up to get involved.

It will be very interesting to witness the impact of Campaigns Wikia and other Internet platforms on future elections.

Thursday, June 22, 2006

T-Shirts, Pens, Mugs and Belt Buckles

Wednesday, May 24, 2006

Not evil, but a pinch of deliberate confusion

I don't have any scientific evidence to back up a full-fledged assertion, but I have always suspected that a key success factor behind the simple text ads that comprise search marketing is their subtleness. They look just like natural search results, and I don't think most consumers actually understand the difference.

I run Google ads on my blog, and last month I received this note from Google:

Evil? Probably not.

Deliberately confusing? Definitely.

I run Google ads on my blog, and last month I received this note from Google:

We're writing to let you know about a coming change to the appearance of your Google ads. Your ads currently display the default Google color palette, Seaside (formerly known as Mother Earth). In the near future, we plan to update the default palette to Open Air, a new palette containing the same set of colors, but without the blue border. We've found that many publishers prefer the cleaner look of this palette and have also seen that a blended color palette performs better for them -- attracting user interest while still maintaining the distinction between ads and content with the 'Ads by Google' label.Big deal, they changed the default colors. Actually it is a big deal -- they eliminated the blue border. Is it me or is this an attempt to further blur the line between content and advertisements? If we polled 1,000 random Internet users, how many really understand that text links are ads?

Evil? Probably not.

Deliberately confusing? Definitely.

Monday, May 15, 2006

Google's Iron

Until today, I didn't fully appreciate how aggressive Google had become with its desire to own datacenters around the world. Of course I have heard countless stories of the massive server farms Google operates. One rumor even suggested Google built a meaningful single digit percentage of all PCs last year.

Still, I was stunned to learn from a young New York based startup about its recent run-in with a hosting service provider (HSP). As background, this startup serves about 1.5 billion monthly page views out of its single datacenter in New York. That's a lot of data, which makes this company a reasonably attractive HSP customer.

A few months ago, its HSP informed the startup that it would not be able to add any more servers to its cage. There was plenty of physical space in the cage, but the HSP claimed it was out of power. There were not enough volts to power any additional servers.

At first, the startup figured someone at the HSP was going to be fired for making such a stupid miscalcuation. How could they not design the place with enough power to operate cages chock full of servers? It just didn't make sense... until they learned what was really going on.

Google had moved to town. It appears Google is trying to purchase as much datacenter capacity as it can find. It offered a certain New York City HSP so much money that the HSP started mistreating its own customers to get them to leave so Google's appetite could be satisfied.

Let this be a warning to other HSP customers around the globe -- beware the day that Google moves to town.

Still, I was stunned to learn from a young New York based startup about its recent run-in with a hosting service provider (HSP). As background, this startup serves about 1.5 billion monthly page views out of its single datacenter in New York. That's a lot of data, which makes this company a reasonably attractive HSP customer.

A few months ago, its HSP informed the startup that it would not be able to add any more servers to its cage. There was plenty of physical space in the cage, but the HSP claimed it was out of power. There were not enough volts to power any additional servers.

At first, the startup figured someone at the HSP was going to be fired for making such a stupid miscalcuation. How could they not design the place with enough power to operate cages chock full of servers? It just didn't make sense... until they learned what was really going on.

Google had moved to town. It appears Google is trying to purchase as much datacenter capacity as it can find. It offered a certain New York City HSP so much money that the HSP started mistreating its own customers to get them to leave so Google's appetite could be satisfied.

Let this be a warning to other HSP customers around the globe -- beware the day that Google moves to town.

Monday, May 08, 2006

Giving good phone

Some people have such great phone voices that it's hard not to want to talk to them. A multi-hundred million industry emerged based on that observation. Marketers persuaded consumers to call 1-900 lines (often, though not always, for sex chat) and relied on their operators' ability to give good phone to keep consumers engaged as the bills ran up at the tune of $5 per minute.

Excellent reporters typically give good phone as well. They use the skill to keep their interview subjects engaged beyond the length of time it makes sense to spend talking to a reporter.

Of course sales executives are often blessed with (or develop?) this talent as well. People buy from people they like, and the first step toward liking someone is talking to them for a while. That's why giving good phone comes in quite handy in sales.

I think I give average phone. Not great, but not awful either. A new service from Ether is allowing me to test how good my phone is. I decided to reserve a short period of time during each of the next few weeks to dispense venture capital advice to people I don't know. I'm mostly curious to see if anyone will take me up on it, and if anyone does, I'll be sure to ask them if I give good phone.

I believe Ether handles all the billing and logistics, though I haven't tried it yet, so I'm not entirely sure. If $2.50 per minute doesn't scare you, give me a call. While I cannot guarantee satisfaction, I promise to talk fast.

Update: As a further inducement to potential callers, all proceeds will be donated to the East Harlem Tutorial Program.

Excellent reporters typically give good phone as well. They use the skill to keep their interview subjects engaged beyond the length of time it makes sense to spend talking to a reporter.

Of course sales executives are often blessed with (or develop?) this talent as well. People buy from people they like, and the first step toward liking someone is talking to them for a while. That's why giving good phone comes in quite handy in sales.

I think I give average phone. Not great, but not awful either. A new service from Ether is allowing me to test how good my phone is. I decided to reserve a short period of time during each of the next few weeks to dispense venture capital advice to people I don't know. I'm mostly curious to see if anyone will take me up on it, and if anyone does, I'll be sure to ask them if I give good phone.

I believe Ether handles all the billing and logistics, though I haven't tried it yet, so I'm not entirely sure. If $2.50 per minute doesn't scare you, give me a call. While I cannot guarantee satisfaction, I promise to talk fast.

JeremyVC 1-888-MY-ETHER ext. 01610091 |

Update: As a further inducement to potential callers, all proceeds will be donated to the East Harlem Tutorial Program.

Thursday, April 06, 2006

Scan Artist Population Continues to Grow

MIT Technology Review's Simon Garfinkel has announced he, too, is a Scan Artist. He has good taste in scanners. Welcome to the club, Simon.

Scan Artist Population Continues to Grow

MIT Technology Review's Simon Garfinkel has announced he, too, is a Scan Artist. He has good taste in scanners. Welcome to the club, Simon.

Saturday, March 18, 2006

Actually, It's Rupert's Third Try

Rupert Murdoch, the man behind News Corporation, has been both praised and ridiculed in the press for propelling his media empire onto the Internet with the acquisition of MySpace. Newsweek called it "Murdoch's New Groove" and the Techdirt headline mockingly shouted "All Hail Lord Murdoch of the Internet" as if to say he just discovered the Internet, and he's already declared himself king.

Regardless of whether you think News Corp's recent MySpace purchase was brilliant or idiotic, you have to hand it to Rupert Murdoch for his persistence. This is at least his third attempt to figure out what a media company should do online.

He was among the very earliest online pioneers with his 1994 purchase of Delphi Internet Services. That foray did not end well (Delphi eventually faded into obscurity), but Murdoch was obviously paying careful attention to the Internet before most of us even had an email address.

That first failure did not deter him. In early 2000, he purchased a significant equity stake in UpMyStreet, which is still one of the most clever local search sites online (unfortunately, it only works in the United Kingdom). UpMyStreet got caught by the trappings of the bubble and was out of cash by 2003. A cash-flow generating young upstart called USwitch.com acquired the assets and has operated UpMyStreet profitably ever since. The US media giant Scripps took notice and bought Uswitch for $366 million last week. Maybe Murdoch was, perhaps, just a bit too early.

Much more recently, News Corp. ventured back online with the purchase of Scout, a collection of online and offline local sports media properties, and MySpace. Many believe MySpace will fade just as quickly as it ascended from an idea to a top-10 Internet property. Though it is unclear whether Murdoch will ultimately regret his recent purchases, it is crystal clear that he has been thinking about and exploring Internet media for quite some time.

Regardless of whether you think News Corp's recent MySpace purchase was brilliant or idiotic, you have to hand it to Rupert Murdoch for his persistence. This is at least his third attempt to figure out what a media company should do online.

He was among the very earliest online pioneers with his 1994 purchase of Delphi Internet Services. That foray did not end well (Delphi eventually faded into obscurity), but Murdoch was obviously paying careful attention to the Internet before most of us even had an email address.

That first failure did not deter him. In early 2000, he purchased a significant equity stake in UpMyStreet, which is still one of the most clever local search sites online (unfortunately, it only works in the United Kingdom). UpMyStreet got caught by the trappings of the bubble and was out of cash by 2003. A cash-flow generating young upstart called USwitch.com acquired the assets and has operated UpMyStreet profitably ever since. The US media giant Scripps took notice and bought Uswitch for $366 million last week. Maybe Murdoch was, perhaps, just a bit too early.

Much more recently, News Corp. ventured back online with the purchase of Scout, a collection of online and offline local sports media properties, and MySpace. Many believe MySpace will fade just as quickly as it ascended from an idea to a top-10 Internet property. Though it is unclear whether Murdoch will ultimately regret his recent purchases, it is crystal clear that he has been thinking about and exploring Internet media for quite some time.

Monday, March 13, 2006

To Yahoo or Not to Yahoo

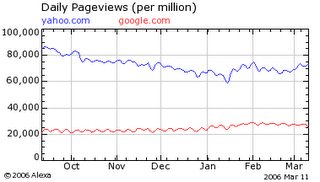

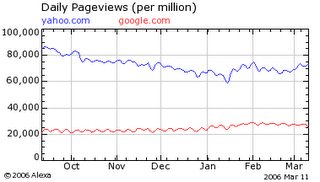

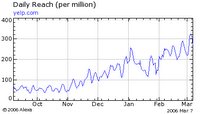

I use Yahoo every day. It is my Firefox homepage and accounts for more of my web traffic than does any other site on the Internet. I'm clearly not alone. According to this Alexa chart, Yahoo serves almost 3x as many pages as Google.

Seven years ago, I invested the time to customize a My Yahoo page and have incrementally added quite a bit to it since then. It has become my primary RSS aggregator, my sports and finance ticker and my first source of news. (I would even use it for web searches, but for some idiotic reason, the folks at Yahoo have not programmed the page to load with the search box in focus; as long as I have to make an extra click, I might as well click in Firefox's Google box.)

Seven years ago, I invested the time to customize a My Yahoo page and have incrementally added quite a bit to it since then. It has become my primary RSS aggregator, my sports and finance ticker and my first source of news. (I would even use it for web searches, but for some idiotic reason, the folks at Yahoo have not programmed the page to load with the search box in focus; as long as I have to make an extra click, I might as well click in Firefox's Google box.)

In a piece for Fortune last week, David Kirkpatrick warns Wall Street not to "stare so hard at Google you miss Yahoo." He highlights Yahoo's relatively cheap P/E ratio of 24x (including a bunch of one-time gains last year including the sale of some Google stock) when compared with Google's 67x . He argues that Yahoo is catching up to Google in terms of search quality and has made some smart moves to capitalize on social networking with its Flickr and Delicious acquisitions. He believes Yahoo will soon be considered Google's peer.

My hedge fund friend thinks otherwise. He questions Yahoo's future relevance entirely. His argument goes something like this: AOL was "stage one" of the Internet -- consumers did not even know how to get online in the early days, and AOL's sheltered dial-up service made it accessible.

Yahoo is stage two of my friend's "training wheels for the Internet" theory. As everyone learned to get online, they needed a place to go that conveniently aggregated their media content and introduced new services. Yahoo served that purpose.

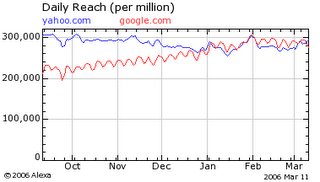

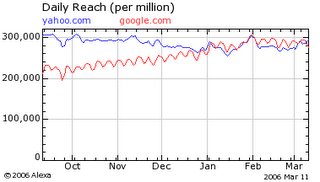

In stage three, however, as consumers finally comprehend and master features like bookmarking and RSS aggregating, will Yahoo still have a purpose? Though I'm currently a devoted Yahoo user, I tend to agree with my hedge fund friend. This Alexa graph supports his theory:

In terms of reach, Yahoo is falling behind. The number of consumers relying on Yahoo the way I do is not growing. Google has overtaken Yahoo as the primary Internet home page, and as users like me find superior best-of-breed alternatives to replace the components of their My Yahoo pages, I suspect the flat blue line in the graph will trend downward.

In terms of reach, Yahoo is falling behind. The number of consumers relying on Yahoo the way I do is not growing. Google has overtaken Yahoo as the primary Internet home page, and as users like me find superior best-of-breed alternatives to replace the components of their My Yahoo pages, I suspect the flat blue line in the graph will trend downward.

Seven years ago, I invested the time to customize a My Yahoo page and have incrementally added quite a bit to it since then. It has become my primary RSS aggregator, my sports and finance ticker and my first source of news. (I would even use it for web searches, but for some idiotic reason, the folks at Yahoo have not programmed the page to load with the search box in focus; as long as I have to make an extra click, I might as well click in Firefox's Google box.)

Seven years ago, I invested the time to customize a My Yahoo page and have incrementally added quite a bit to it since then. It has become my primary RSS aggregator, my sports and finance ticker and my first source of news. (I would even use it for web searches, but for some idiotic reason, the folks at Yahoo have not programmed the page to load with the search box in focus; as long as I have to make an extra click, I might as well click in Firefox's Google box.)In a piece for Fortune last week, David Kirkpatrick warns Wall Street not to "stare so hard at Google you miss Yahoo." He highlights Yahoo's relatively cheap P/E ratio of 24x (including a bunch of one-time gains last year including the sale of some Google stock) when compared with Google's 67x . He argues that Yahoo is catching up to Google in terms of search quality and has made some smart moves to capitalize on social networking with its Flickr and Delicious acquisitions. He believes Yahoo will soon be considered Google's peer.

My hedge fund friend thinks otherwise. He questions Yahoo's future relevance entirely. His argument goes something like this: AOL was "stage one" of the Internet -- consumers did not even know how to get online in the early days, and AOL's sheltered dial-up service made it accessible.

Yahoo is stage two of my friend's "training wheels for the Internet" theory. As everyone learned to get online, they needed a place to go that conveniently aggregated their media content and introduced new services. Yahoo served that purpose.

In stage three, however, as consumers finally comprehend and master features like bookmarking and RSS aggregating, will Yahoo still have a purpose? Though I'm currently a devoted Yahoo user, I tend to agree with my hedge fund friend. This Alexa graph supports his theory:

In terms of reach, Yahoo is falling behind. The number of consumers relying on Yahoo the way I do is not growing. Google has overtaken Yahoo as the primary Internet home page, and as users like me find superior best-of-breed alternatives to replace the components of their My Yahoo pages, I suspect the flat blue line in the graph will trend downward.

In terms of reach, Yahoo is falling behind. The number of consumers relying on Yahoo the way I do is not growing. Google has overtaken Yahoo as the primary Internet home page, and as users like me find superior best-of-breed alternatives to replace the components of their My Yahoo pages, I suspect the flat blue line in the graph will trend downward.

Wednesday, March 08, 2006

A Helping of my Yelping

In this blog, I have focused on topics related to areas I think are ripe with innovation and, therefore, present fertile ground for venture investing. And I have rambled on about miscellaneous gadgets, technologies and anecdotes that have captured my imagination (or at least my attention). I deliberately shied away from referring to my Bessemer investments to prevent this from becoming a shameless promotional tool. I included the simple link to my investments in the right-hand column and left it at that.

Until now!

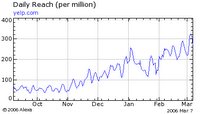

If you haven't already explored Yelp, now would be a good time to check it out. If you wait much longer, you'll qualify for luddite status, because the rest of the Internet population will have discovered it before you. This is what one might call a blog brag, but here is Alexa's summary of Yelp's recent traffic growth:

For investors, few things in life are more pleasing than graphs that go up and to the right.

For investors, few things in life are more pleasing than graphs that go up and to the right.

So, why did I invest in Yelp, and what is it?

My investment in Yelp was an outgrowth of my interest in community-oriented, user-generated content, but I'll blog more about that later. Yelp solves what I call "the Citysearch problem." I used to love Citysearch. It showcased what other people thought about everything local -- stores, restaurants, dentists, auto mechanics, etc. But over time it became virtually impossible to find a negative review about anything. All the content read like it had been written by a close relative of the store owner.

Enter Yelp. Yelp reveals who is behind the opinions. It lets you determine whether you share the same sensibilities as each reviewer. And then you can discover other local establishments you otherwise might never have found. Instinctively, we all consult friends for referrals when we're in need of a new doctor, the right restaurant for a special date, or a trustworthy mechanic. Yelp adds the power and scale of the Internet to these word-of-mouth referrals.

Yelp is also trying to become a verb. To Yelp about something is to share one's opinions. Mine accumulate at jeremyl.yelp.com. I have also added a helping of my Yelping to the right-hand column of this blog. Yelp's nifty Maptastic feature plots my reviews on a Google map. You can tell I spend most of my time bouncing between San Francisco and New York.

Yelp's talented team managed to incorporate the user interface je ne seis quoi which makes some sites really slick and fun to use. When you sign up, click Member Search near the top right of the page to search for me and add me as a friend.

Until now!

If you haven't already explored Yelp, now would be a good time to check it out. If you wait much longer, you'll qualify for luddite status, because the rest of the Internet population will have discovered it before you. This is what one might call a blog brag, but here is Alexa's summary of Yelp's recent traffic growth:

For investors, few things in life are more pleasing than graphs that go up and to the right.

For investors, few things in life are more pleasing than graphs that go up and to the right.So, why did I invest in Yelp, and what is it?

My investment in Yelp was an outgrowth of my interest in community-oriented, user-generated content, but I'll blog more about that later. Yelp solves what I call "the Citysearch problem." I used to love Citysearch. It showcased what other people thought about everything local -- stores, restaurants, dentists, auto mechanics, etc. But over time it became virtually impossible to find a negative review about anything. All the content read like it had been written by a close relative of the store owner.

Enter Yelp. Yelp reveals who is behind the opinions. It lets you determine whether you share the same sensibilities as each reviewer. And then you can discover other local establishments you otherwise might never have found. Instinctively, we all consult friends for referrals when we're in need of a new doctor, the right restaurant for a special date, or a trustworthy mechanic. Yelp adds the power and scale of the Internet to these word-of-mouth referrals.

Yelp is also trying to become a verb. To Yelp about something is to share one's opinions. Mine accumulate at jeremyl.yelp.com. I have also added a helping of my Yelping to the right-hand column of this blog. Yelp's nifty Maptastic feature plots my reviews on a Google map. You can tell I spend most of my time bouncing between San Francisco and New York.

Yelp's talented team managed to incorporate the user interface je ne seis quoi which makes some sites really slick and fun to use. When you sign up, click Member Search near the top right of the page to search for me and add me as a friend.

Wednesday, February 01, 2006

Infoworld Agrees with Me

In one of my blog postings from last September (here), I celebrated the arrival of a fabulous new Fujitsu desktop scanner. My colleague James Cham just pointed out that it took Infoworld an extra five months to make the same observation here.

Though meaningless in the scheme of things, it feels good to scoop the tech press.

Though meaningless in the scheme of things, it feels good to scoop the tech press.

Subscribe to:

Posts (Atom)