I guess I'm a little tired (and admittedly envious) of all the hype and adulation that surround Google. Clearly the company is doing a lot of things right. How else can you explain its unstoppable revenue and earnings growth?

However, I'd still bet against some of Google's choices. One strategy I disagree with is Google's often-cited policy that its engineers can devote up to 20% of their work time to personal research projects. Google justifies this as an investment in innovation presumably because its talented employees will cook up some new ideas that will, over time, flourish into billion-dollar businesses. This August 2005 Always On article does a decent job overviewing Google's innovation efforts.

But every entrepreneur knows it takes a *lot* more than a 20% effort to innovate. It takes more like 120%. I'd much rather bet on a charged-up entrepreneur who is fully dedicated to an innovation than on a Google engineer spending just a fraction of his time.

Of course I do find myself thinking (and asking entrepreneurs) about how a new startup plans to address the "Google risk," but it's not out of fear related to Google's 20% innovation time policy. In fact, I wonder if the 20% innovation time is really just a distraction from productive work for most of Google's staffers.

Meanwhile, I'm delighted to be working with and investing in entrepreneurs who give more than 100%, because it's impossible to get anything done with any less effort.

Wednesday, October 26, 2005

Monday, October 10, 2005

Impossible to predict

Consumers are bizarre. Surprising. Unpredictable. But most importantly, there are about six billion of them. About 600 million are on the internet, and 1.8 billion have cell phones.

With a group that large, you can find just about everything. In fact, you can find thousands of anything.

Well, imagine I told you that a college-bound kid put up a web page with a giant grid on it. Let's say he offered to sell squares on the grid -- each 10 pixels x 10 pixels -- for $1 per pixel (or $100 per square). How many could he sell?

If you're like me, you'd probably guess zero. Or maybe a handful to some friends as a gimmick. Well, you'd be wrong. Very wrong.

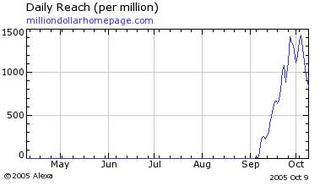

I haven't done the research to verify this isn't a sham, but it certainly looks real. Check out The Million Dollar Homepage. Start at the very bottom of the associated blog and read up. A teenager named Alex in the UK put up the site 6 1/2 weeks ago and has collected $323,200 as of this morning! The site is a wild hit. Here is its Alexa ranking growth:

With a simple, clever, gimmicky idea, Alex found a way to strike that certain chord with a large segment of consumers. Ostensibly, he launched the site to pay for his university education. The $300 grand he has already collected buys a few degrees with a couple of sports cars on the side. Yet people keep buying his virtual real estate.

With a simple, clever, gimmicky idea, Alex found a way to strike that certain chord with a large segment of consumers. Ostensibly, he launched the site to pay for his university education. The $300 grand he has already collected buys a few degrees with a couple of sports cars on the side. Yet people keep buying his virtual real estate.

Last week I spoke on a panel organized by the Young Venture Capital Society in New York. The event was titled "Understanding Consumer Media." My fellow panelists included Danny Schultz, Andrew Zalasin, Steve Brotman and Mitch Davis. We each had a slightly different take on consumer technology investing and entrepreneurship, but I think one of the most important points we discussed was the difficulty of predicting what will work with consumers. The Million Dollar Homepage is a wonderful example of that challenge. It may also be an illustration of an age old maxim: "A fool and his money are soon parted."

Hats off to Alex for a creative idea and an entertaining blog to go with it.

With a group that large, you can find just about everything. In fact, you can find thousands of anything.

Well, imagine I told you that a college-bound kid put up a web page with a giant grid on it. Let's say he offered to sell squares on the grid -- each 10 pixels x 10 pixels -- for $1 per pixel (or $100 per square). How many could he sell?

If you're like me, you'd probably guess zero. Or maybe a handful to some friends as a gimmick. Well, you'd be wrong. Very wrong.

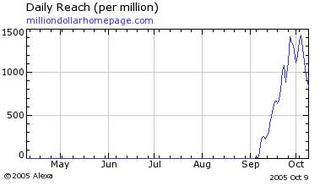

I haven't done the research to verify this isn't a sham, but it certainly looks real. Check out The Million Dollar Homepage. Start at the very bottom of the associated blog and read up. A teenager named Alex in the UK put up the site 6 1/2 weeks ago and has collected $323,200 as of this morning! The site is a wild hit. Here is its Alexa ranking growth:

With a simple, clever, gimmicky idea, Alex found a way to strike that certain chord with a large segment of consumers. Ostensibly, he launched the site to pay for his university education. The $300 grand he has already collected buys a few degrees with a couple of sports cars on the side. Yet people keep buying his virtual real estate.

With a simple, clever, gimmicky idea, Alex found a way to strike that certain chord with a large segment of consumers. Ostensibly, he launched the site to pay for his university education. The $300 grand he has already collected buys a few degrees with a couple of sports cars on the side. Yet people keep buying his virtual real estate.Last week I spoke on a panel organized by the Young Venture Capital Society in New York. The event was titled "Understanding Consumer Media." My fellow panelists included Danny Schultz, Andrew Zalasin, Steve Brotman and Mitch Davis. We each had a slightly different take on consumer technology investing and entrepreneurship, but I think one of the most important points we discussed was the difficulty of predicting what will work with consumers. The Million Dollar Homepage is a wonderful example of that challenge. It may also be an illustration of an age old maxim: "A fool and his money are soon parted."

Hats off to Alex for a creative idea and an entertaining blog to go with it.

Friday, October 07, 2005

A Very Pleasant "Hissing" Sound!

Sometimes bubbles go "pop!" Remember April 2000? But they often deflate slowly like a tire with a small leak. If you listen carefully, you can hear a hissing sound.

Well, I am delighted finally to see some evidence of hissing. No, I'm not referring to the rapidly inflating Web 2.0 bubble (see David Cowan's comments on this week's Web 2.0 Conference here). I'm referring to the bubble that just refuses to pop even after 12 years of near-constant inflation. I mean the Manhattan real estate bubble.

For almost 18 months now, there have been articles every day in all the major newspapers describing an ever intensifying real estate run-up. Finally, this weekend, the first major cracks appeared. And for someone who has been (foolishly?) sitting out of the real estate market for 10 years now, it's an enormous relief.

I hope the articles like this one from Sunday's New York Times continue. The article quoted a report by Miller Samuel, one of New York's most reputable appraisal firms, and by Douglas Elliman, one of the region's top real estate brokers, claiming average sale prices declined 13% in Q3 from Q2. The same report said that median prices fell 3.2% (to what remains a whopping $750,000). Of course that means the high end of the market is collapsing the fastest, and I hope that's a strong indicator of additional compression to come.

As Rob Stavis put it to me recently, "Not owning any real estate is effectively equivalent to being short a unit." He argued that since we all need a place to live, not owning any property is like being short relative to one's long-term real estate needs.

Well, I'm anxious to cover the short, and I hope the market finally cooperates.

Well, I am delighted finally to see some evidence of hissing. No, I'm not referring to the rapidly inflating Web 2.0 bubble (see David Cowan's comments on this week's Web 2.0 Conference here). I'm referring to the bubble that just refuses to pop even after 12 years of near-constant inflation. I mean the Manhattan real estate bubble.

For almost 18 months now, there have been articles every day in all the major newspapers describing an ever intensifying real estate run-up. Finally, this weekend, the first major cracks appeared. And for someone who has been (foolishly?) sitting out of the real estate market for 10 years now, it's an enormous relief.

I hope the articles like this one from Sunday's New York Times continue. The article quoted a report by Miller Samuel, one of New York's most reputable appraisal firms, and by Douglas Elliman, one of the region's top real estate brokers, claiming average sale prices declined 13% in Q3 from Q2. The same report said that median prices fell 3.2% (to what remains a whopping $750,000). Of course that means the high end of the market is collapsing the fastest, and I hope that's a strong indicator of additional compression to come.

As Rob Stavis put it to me recently, "Not owning any real estate is effectively equivalent to being short a unit." He argued that since we all need a place to live, not owning any property is like being short relative to one's long-term real estate needs.

Well, I'm anxious to cover the short, and I hope the market finally cooperates.

Subscribe to:

Comments (Atom)